This is my annual post listing books I read in the most recent year. It seems kind of hard to believe, but I have produced such a post since 2005. This is a link to the 2022 list if blog readers want to work backwards.

Non-Fiction

Amitav Ghosh, The Great Derangement; Climate Change and the Unthinkable

Samara Klar and Yanna Krupnikov, Independent Politics: How American Disdain for Parties Leads to Political Inaction

David Maraniss, Clemente; The Passion and Grace of Baseball's Last Hero

Satchell Paige, Maybe I'll Pitch Forever

Bill James, Bill James Handbook, Walk-Off Edition

Sean Forman, The Negro Leagues are Major Leagues

Anne Jewell, Baseball In Louisville

Jeff Silverman, The Greatest Baseball Stories Ever Told: Thirty Unforgettable Tales from the Diamond

Buzz Bissinger, Three Nights in August; Strategy, Heartbreak, and Joy Inside the Mind of a Manager

Robert D. Kaplan, The Tragic Mind; Fear, Fate, and the Burden of Power

I read several books about climate change this year, but Ghosh's book is the only one that is not fiction. Ghosh writes a great deal about the need for artists to create content about climate change and he emphasizes the importance of imagining some of the catastrophic potential outcomes.

The Klar and Krupnikov book I got via ILL and read it for a project I'm working on with a colleague. The Maraniss and Paige bio and autobiography are definitely worth your time. I was inspired to read about Clemente after attending a Pirates game in Pittsburgh.

I've purchased just about every book Bill James has written about baseball, including the annual Handbook (he is a contributor), but this book was disappointing. I realize the publisher is ending the run of this book because the stats are virtually all available on the internet, but I like to have them all together in one book that I can read at my leisure in my living room without a computer or device. This book does not include very many of the stats long associated with the book. The essays are fine, but the product is below the standard set by the prior editions.

The Silverman edited volume has some great pieces, but I'd previously read most of the best ones. Some of the entries are not that great.

Literature and Genre Fiction

Larry McMurtry, Terms of Endearment

Anne Tyler, Dinner at the Homesick Restaurant

Nick Hornby, Just Like You

John Updike, Bech is Back

Jenny Offill, Weather

Yevgeny Zamyatin, We

I don't know why I've only recently read Terms of Endearment. I read the prior book in the Houston series decades ago. And I saw the movie with Shirley MacLaine and Jack Nicholson soon after it appeared. Oh well.

Anne Tyler and Nick Hornby are always worth reading and I enjoyed both these books a great deal.

The Bech book is really a set of short stories. It's OK, but uneven for this reason.

The Offill book didn't really click with me, though it occasionally mentions climate change. Zamyatin's We is a classic, but it seemed to fall short of my expectations for dystopian fiction.

Genre fiction:

Kurt Anderson, True Believers

Colson Whitehead, Crook Manifesto

Walter Mosley, Bad Boy Brawly Brown

Michael Connelly, Trunk Music

Jason Matthews, Palace of Treason

Derek Raymond, He Died With His Eyes Open

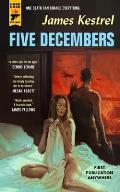

I'd say these books were the cream of the crop. Kestrel's book is excellent and I urge everyone to read it. Kestrel, Anderson, and Matthews have all written books featuring spies and espionage so it was another good year for reading that sort of fiction.

Whitehead, Mosley, Connelly, and Raymond work in the crime genre and these are captivating examples.

Ward Just, Exiles in the Garden

M is for Malice, Sue Grafton

Joe Gores, Hammett

R.D. Rosen, Dead Ball

Richard McGuire, Here

Ian Fleming, On Her Majesty's Secret Service

Donald Westlake, Brothers Keepers

Donald Hamilton, Death of a Citizen

Richard Stark (Donald Westlake), Slayground

David Goodis, The Wounded and the Slain

Charles Willeford, The Burnt Orange Heresy

Robert B. Parker, Taming a Sea Horse

Loren Estleman, Angel Eyes

Ross McDonald, Sleeping Beauty

Donald Westlake, The Hook

Claudia Davila, Luz Sees the Light

Carl Hiaasen, Star Island

Christopher Buckley, Make Russia Great Again

Jack Handey, The Stench of Honolulu

Many, actually most, of the other authors are familiar from past iterations of this summary report. You'll find books here from the Kinsey Milhone, Easy Rawlins, Spencer, and Lew Archer detective series, which I'm generally reading in order.

There are a couple of graphic novels about climate change on this list. Here is an interesting concept as the artist has drawn the changes over time to a single plot of land. The Luz book is for children, which means it is a quick read.

Many of these books were OK, but most were so-so and had some serious flaws. I'm not going to be detailing all of those here, but you can probably find out on my Goodreads account.

Buckley and Handey prove that it can be difficult to be funny.

Visit this blog's homepage.

For 280 character IR and foreign policy talk, follow me on twitter.

Or for basketball, baseball, movies or other stuff, follow

this personal twitter account.